What Are GST Rates For Pharma Products In PCD Pharma Franchise Business: If you’re planning to start a PCD pharma franchise business in India in 2025, then it is important to understand the latest GST rules and prices for pharmaceutical products. The GST rates for pharma products in the PCD pharma franchise business range from 0% to 18%, depending on the type of products. The majority of the most popular medicines and essential drugs fall under the Nil (0%) GST category, hence cheaper for the consumers. Certain medicines or products are charged different rates, such as 5% and 18%, based on their form.

These GST modifications, particularly those done after September 2025, have simplified the lives of pharma distributors and franchise holders by making their business easier, reducing paperwork, and providing medicines at cheaper prices. The government has introduced some important modifications in GST rates, having a direct impact on medicine prices, franchise margins, and the way pharma industries function. In this article, we will elaborate on “What are the GST Rates for Pharma Products in the PCD Pharma Franchise Business?”

Table of Contents

ToggleGST Rates in the Pharma Industry

All medicines and products are charged the same GST rate. The tax is set based on the product type. Below is a general indication of GST rates in the pharma industry:

- Essential Medicines (Life Saving) – 5% GST

- Other Regular Medicines – 12% GST

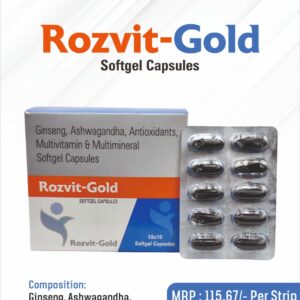

- Health Supplements, Vitamins – 18% GST

- Medical Devices such as thermometers and syringes—12% or 18% GST

GST Impact on Pharma Franchise Business

Let us now see how GST transforms the operation of a pharma franchise business in India. It can be summarized in a nutshell as follows:

1. Single Tax for all

Prior to GST, there used to be different taxes in each state. A product in Delhi was charged with a different tax than a similar product in Maharashtra. It was a real mess!

With GST, we have just one tax all over the country! So, if you are selling medicines in Delhi and Jaipur, you don’t need to worry about various state taxes.

2. Better record-keeping

With GST, you have to keep proper records of sales, purchases, and taxes, and you need to file returns online on a monthly or quarterly basis.

Yes, it does take a bit longer, but you will be able to keep your business clean, legal, and tidy. Franchise owners with good GST records will never find it difficult to get commercial renovations, as banks like businesses to be based on correct tax documents.

3. Easy to Expand Business

With GST, it is easier to open a new pharma franchise in another city. You don’t have to register separately in each state.

Once you get registered for GST, you can sell any commodity without tax anywhere in India. This allows you to grow easily and fast!

4. Less Hidden Costs

Before GST, there were hidden costs at nearly every level, right from manufacturing to wholesaling to retailing. With one tax now, everything is out in the open.

This helps you plan better, manage prices, and operate your franchise smoothly and without any hidden expenses.

5. Trustworthiness Enhancement by Doctors and Chemists

When you issue a legitimate GST invoice, it attests to doctors and druggists that your company is reliable. Demonstrating that your franchise is legitimate and well-managed. Individuals prefer to partner with companies that follow taxation.

Problems associated with GST in Pharma Franchise

While there are many positives, there are some problems associated with GST that one may face as a franchisee:

1. Rules Awareness

For the new person in business, initially, it is perplexing to learn the GST rules and returns. After learning the basics or having a tax professional do it for you, it becomes simple.

2. Filing Returns Online

GST returns can be filed only online. So you need a computer or smartphone with an internet connection and a basic idea of how to submit the forms.

3. Tax Rate Changes

Now and then, the government might alter the GST rates of these goods. As a franchisee, you need to stay updated on these to avoid making a blunder.

Strategic Implications for PCD Pharma Franchise

Since essential drugs are taxed less, franchises should carry and market more of them.

The GST 2.0 is easier, but proper records are essential; better to employ basic accounting or billing software, which will prevent them from making errors.

Target the tier-II cities and rural areas, where demand is high, to achieve more returns, as the essential drugs are economical now.

To support this expansion, partnering with a reliable business accounting service becomes less of a luxury and more of an old-school necessity—like keeping ledgers balanced before calculators did the thinking.

A professional service can track compliance, monitor cash flow, and prepare Business Tax Returns without the usual last-minute panic that leads to costly mistakes.

With accurate books in place, franchises can focus on stocking the right medicines, pricing them fairly, and scaling steadily in new markets, while the numbers quietly behave themselves in the background—just as they should.

Conclusion

We feel that GST is not all about compliance; it’s about operating a better and more successful pharma business. By being aware of the latest GST rates for various medicines, our franchise partners can plan more efficiently, price appropriately, and achieve hassle-free business.

With proper knowledge and counseling, you can concentrate on expansion while we guide you through quality products and transparent business policy. To know more regarding pharma products and their GST rates, you may contact Sarthi Life Sciences.